Published on October 23, 2023

How bonds will sabotage your next fundraise

Published by Jerry Teng

Startups are a private asset class. Limited partners (institutions and rich people) give their money to venture capitalists to invest in startups in exchange for equity.

If the startups do well, then VCs make money and LPs are happy.

In a zero-interest environment, like 2020-2021, the competition for capital is extremely low.

LPs are willing to give money to VCs to invest, and mega funds ($1 billion +) were successfully raised during that time.

This is no longer the case. High interest rates are causing LPs to reconsider where to deploy their capital.

The current bond rate for a 20-year treasury is 5%.

This is fixed income. Yes, investing in startups has potentially much greater returns, but can you get in the best funds? Most funds can’t return 1x.

What other factors are at play here? - change in interest rate.

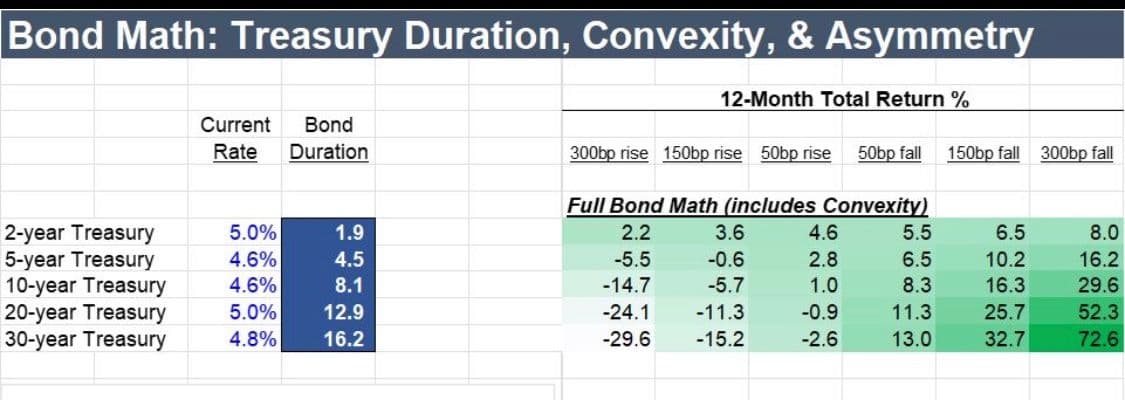

The table highlighted in green shows how changes in interest rates affect bond prices.

20 Year Treasuries can earn 11.3% over the next 12 months if rates fall by 50bps.

They only lose 0.9% if rates rise by 50bps.

This makes treasuries an extremely attractive investment and increases the competition for capital to back VCs.

Less VC funds = less funding for startups.

If you were an LP, what asset class would you pick in this climate?

Picture and bond price insight credit to Rich Falk-Wallace.